3 reasons why it could be a rocky week for Crypto currency (Bitcoin, Ethereum and altcoins)

- The crypto market lacks positive excitement, continuing the trend that began in 2022. There are a few reasons why volatility could rise in January, even though Bitcoin BTC is down $16,821 and altcoins have remained stable until 2023. Market caps during the 2022 holiday period. Source: Arcane Research

The Winklevoss Letter to DCG incites FUD about bankruptcy.

- Gemini co-founder Cameron Winklevoss wrote an open letter to Digital Currency Group (DCG) founder Barry Silbert on January 2 asking for clarification on the $900 million in locked customer funds. Gemini and Silbert collaborated on the "Earn" program; however, DCG liquidity issues have prevented $900 million in customer funds from being accessible since November 16. Crypto Twitter began spreading false information about DCG following the letter, claiming that there were liquidity issues similar to those of 3 Arrows Capital and FTX.

- DCG may be forced to sell large positions in GBTC and ETHE trusts, as well as other positions in trusts managed by their sister company Grayscale, as a result of the large Gemini hole. Arcane Research says that DCG could meet its debt obligations in a different way by starting a Reg M distribution. This would allow holders of GBTC and ETHE positions to exchange their holdings for the underlying assets in a 1:1 ratio.

- Arcane Research senior analyst Vetle Lunde noted:

Grayscale trust holdings of circulating supply. Source: Arcane Research

Fear is high and liquidity is low

- Gemini co-founder Cameron Winklevoss wrote an open letter to Dhe DCG on January 2, and the Gemini drama occurs at a time when market sentiment is low. The majority of market participants are not optimistic and are reluctant to engage with risk assets, despite evidence that investors intend to participate in crypto in 2023. The index is currently at 26 on a scale of 100, which is the same as it was in December.

Fear and greed index. Source: Alternative.me

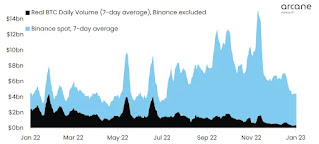

- During times of low liquidity, a high level of fear is even more significant. Market activity continues to decline, reaching levels not seen since June 24, when Binance introduced zero-fee trading for BTC pairs. The low spot trading volumes suggest that there will be little interest in the market early this year. BTC volume with and without Binance. Source: Arcane Research

- A short-term price decline in cryptocurrencies could become more pronounced if DCG pursues the Reg M strategy and spot market volume remains low.

The upcoming economic calendar hints at possible volatility

- ISM manufacturing PMI (US factory activity)

- US JOLTs (job openings)

- Federal Open Market Committee (FOMC) meeting minutes

Thursday, Jan. 5:

- US balance of trade

Friday, Jan. 6:

- Nonfarm payrolls and unemployment data

- ISM non-manufacturing PMI (a survey of business conditio)

Sunday, Jan. 8:

- Gemini settlement offer to DCG expires

Thursday, Jan. 12:

- US consumer price index (CPI) report on inflation

Friday, Jan. 13:

- US banks start Q4 2022 earnings reports

The equities market may react by selling off if the numbers fall short of expectations or if something unusual occurs.

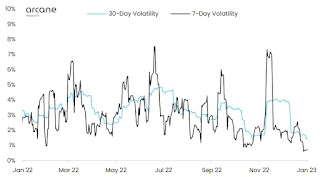

BTC volatility has reached a 2.5-year low in tandem with lower spot volumes. Lunde claims that the low volatility period won't last very long

“These low volatility periods rarely last for long, and volatility compression periods have previously tended to be followed by sharp moves, even in stagnant markets.”

BTC 7 and 30-day volatility. Source: Arcane Research

A few examiners trust that the Jan. 12 US CPI report will show a spike in expansion. The Federal Reserve may keep raising interest rates if this is the case, which has previously led to a decline in crypto's market cap.

The cryptocurrency market may react with another drop to the downside as a result of the current market sentiment, the possibility of DCG bankruptcy, and decreased market liquidity. Additionally, there is a possibility of additional interest rate hikes.

.jpg)

.jpg)

.png)